Last updated on 27 Jan, 2026

UBL Travel Insurance: The Smart Way to Travel Without Worry

Introduction

Every traveler dreams of a seamless journey—smooth flights, breathtaking destinations, and unforgettable experiences. Yet, the reality of travel often includes unexpected disruptions: canceled flights, lost luggage, sudden illness, or even medical emergencies in a foreign country. The biggest pain point for modern travelers is not planning the trip itself—it is facing these uncertainties without adequate protection. Many people assume that mishaps “won’t happen to them,” only to discover too late that the cost of an emergency abroad can be devastating.

Inadequate travel insurance coverage exposes travelers to financial loss, emotional stress, and logistical nightmares. A single medical emergency during an international trip can cost thousands of dollars, while a canceled flight can derail carefully planned itineraries. This is why choosing a reliable insurance provider is no longer optional—it is essential. UBL travel insurance addresses this exact problem by offering comprehensive protection tailored to modern travel needs, ensuring peace of mind from departure to return.

In this guide, we will explore how travel insurance works, why UBL stands out, and how travelers can select the best coverage for their journeys. Whether you are searching for best travel insurance plans, affordable travel insurance, or travel insurance for international trips, this article will help you make a confident, informed decision.

Understanding Travel Insurance

Travel insurance is a financial safety net designed to protect travelers against unforeseen events before and during their trip. It acts as a shield against risks that could otherwise turn an exciting journey into a costly ordeal. At its core, travel insurance covers expenses related to medical emergencies, trip cancellations, lost baggage, travel delays, and personal accidents.

The main types of travel insurance include:

-

Travel Medical Insurance – Covers emergency medical treatment, hospitalization, and evacuation abroad.

-

Trip Cancellation Insurance – Reimburses prepaid costs if a trip is canceled due to covered reasons.

-

Single Trip Insurance – Ideal for one-time travelers planning a specific journey.

-

Annual Travel Insurance – Designed for frequent travelers who take multiple trips in a year.

-

Family Travel Insurance – Offers bundled coverage for families traveling together.

-

Comprehensive Travel Plans – Combine medical, cancellation, baggage, and delay protection.

These options allow travelers to tailor coverage based on their travel style. Whether you are comparing travel insurance reviews or performing a detailed travel insurance comparison, understanding these categories is the first step toward smarter protection.

The Importance of UBL Travel Insurance

Among the many providers in the market, UBL travel insurance stands out for its reliability, accessibility, and traveler-focused coverage. Backed by a reputable financial institution, UBL offers plans that are designed specifically for both domestic and international travelers.

Key benefits of UBL Travel Insurance include:

-

Comprehensive medical coverage for emergencies abroad

-

Protection against trip cancellations and delays

-

Baggage loss and personal belongings coverage

-

Affordable premiums without sacrificing quality

-

Easy claim processes and customer support

-

Options for single trips, families, and frequent travelers

When compared with other providers, UBL delivers exceptional value by combining affordability with robust benefits. Many affordable travel insurance plans cut corners, leaving travelers underinsured. UBL, however, maintains a balance between cost and comprehensive protection. This makes it an excellent option for those seeking best travel insurance plans without overpaying.

For travelers planning international journeys, UBL travel insurance offers peace of mind that extends beyond borders. It ensures that medical care, emergencies, and disruptions are handled efficiently—no matter where you are in the world.

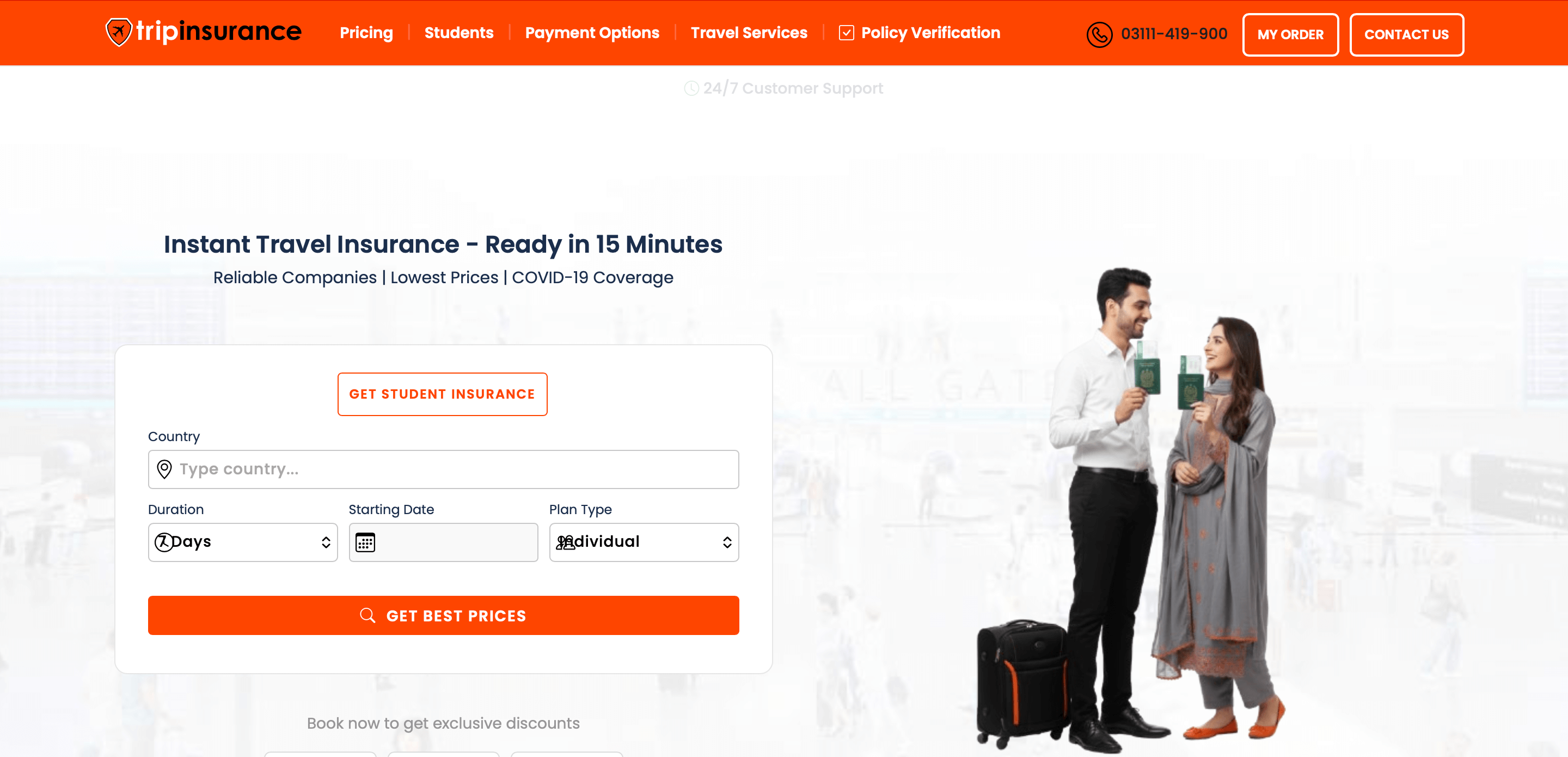

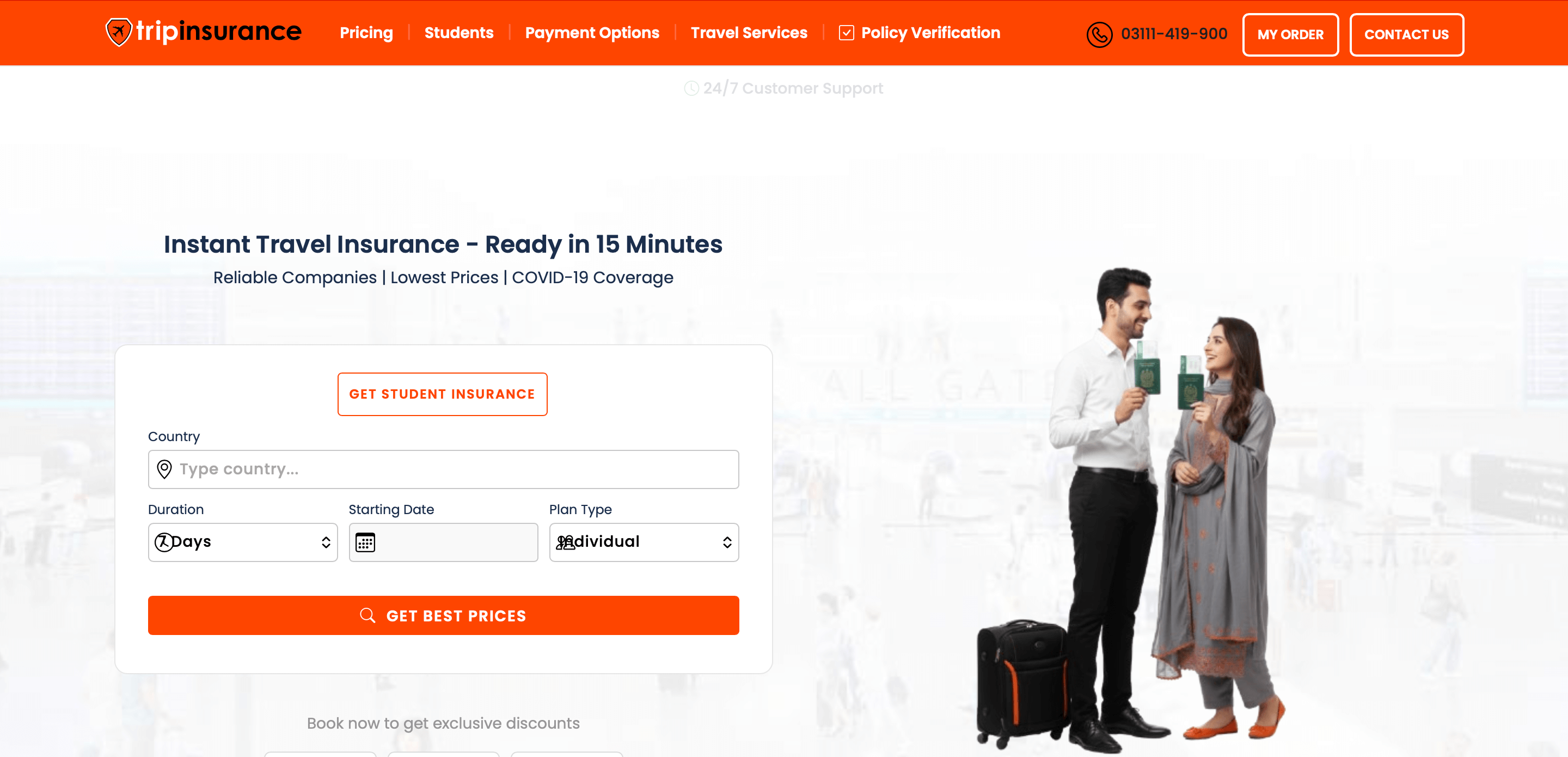

Why We Recommend Buying Through Trip Insurance PK

Choosing the right insurance provider is only half the decision. The platform you use matters equally. Trip Insurance PK simplifies the process of purchasing UBL Travel Insurance by offering clarity, guidance, and verified policy options.

-Policy Comparison and Expert Guidance

We help travelers understand coverage limits, exclusions, and benefits before purchase. This ensures informed decisions rather than rushed selections.

-Fast Documentation for Visa Applications

Time-sensitive visa processes require quick insurance documentation. We provide prompt policy issuance and accurate certificates accepted by embassies.

-Transparent Pricing

No hidden charges. We present clear pricing with policy details, allowing travelers to choose coverage that fits their budget and travel needs.

-Dedicated Customer Support

From policy selection to post-purchase queries, we assist travelers at every step. Our focus is long-term trust, not one-time transactions.

Common Misconceptions About Travel Insurance

Despite its importance, travel insurance is often misunderstood. These misconceptions prevent travelers from securing adequate coverage:

-

“I don’t need insurance for short trips.”

Even a weekend trip can be disrupted by illness, delays, or lost luggage.

-

“My credit card covers everything.”

Credit card coverage is often limited and excludes medical emergencies.

-

“Travel insurance is too expensive.”

In reality, affordable travel insurance costs far less than a single hospital visit abroad.

-

“Nothing will go wrong.”

Travel risks are unpredictable. Insurance exists precisely because uncertainty is unavoidable.

Understanding these myths helps travelers realize that insurance is not an unnecessary expense—it is a strategic investment in safety and peace of mind.

How to Choose the Right Travel Insurance

Selecting the right travel insurance requires careful evaluation of personal needs and travel habits. Not every traveler requires the same level of protection, and the best plan is one that aligns with your journey.

Consider the following factors:

-

Destination and duration of travel

-

Frequency of trips per year

-

Age and health condition of travelers

-

Activities planned (adventure sports, business travel, leisure)

-

Budget and level of coverage required

A simple comparison can help:

| Travel Type |

Recommended Coverage |

| One-time vacation |

Single Trip Insurance |

| Multiple yearly trips |

Annual Travel Insurance |

| Family vacations |

Family Travel Insurance |

| International travel |

Comprehensive + Medical Coverage |

Performing a travel insurance comparison ensures that you select a plan offering both protection and value. UBL travel insurance provides flexible plans that cater to all these needs, making it easier to find the right fit without unnecessary complexity.

Cost Considerations and Value of Travel Insurance

Many travelers hesitate because they focus on the cost rather than the value. Travel insurance typically costs only a small percentage of the total trip expense, yet it can save thousands in emergencies. A delayed flight, lost luggage, or medical emergency abroad can far exceed the price of a policy.

With UBL travel insurance, travelers benefit from:

Instead of viewing insurance as an added cost, think of it as protection for your entire investment in travel. When compared to potential losses, the value becomes undeniable. In a world where disruptions are increasingly common, insurance is not a luxury—it is a necessity.

Claims Support and Reliability

A travel insurance policy proves its value during claims. UBL Travel Insurance follows defined claim procedures supported by documentation. Through Trip Insurance PK, we assist clients in understanding claim steps, required documents, and timelines, ensuring smoother claim experiences.

Frequently Asked Questions (FAQ)

1. Is UBL travel insurance suitable for international trips?

Yes. UBL travel insurance is designed for travel insurance for international trips and meets the coverage requirements for many visa applications.

2. Does UBL travel insurance cover medical emergencies?

Yes. It includes travel medical insurance that covers hospitalization, emergency treatment, and related medical expenses abroad.

3. Can families get covered under one plan?

Yes. UBL offers family travel insurance, allowing multiple family members to be covered under a single policy.

4. What happens if my trip gets canceled?

Trip cancellation insurance covers prepaid expenses if your trip is canceled due to covered reasons such as medical emergencies or unforeseen events.

5. Is annual travel insurance worth it?

If you travel multiple times a year, annual travel insurance is often more cost-effective than purchasing separate policies for each trip.

Conclusion

Traveling without proper insurance is a gamble no modern traveler should take. From medical emergencies to canceled flights and lost baggage, the risks are real and often expensive. UBL travel insurance offers a reliable solution that balances comprehensive coverage with affordability, making it suitable for a wide range of travelers.

By understanding your needs, comparing plans carefully, and choosing a trusted provider, you protect not only your trip but also your financial well-being. Whether you are planning a single vacation or multiple international journeys, investing in the right travel insurance is a smart, responsible decision.

To explore and purchase UBL travel insurance with confidence, visit

Trip Insurance PK and secure your journey before you take off.