Last updated on 13 Jan, 2026

Why Schengen Travel Insurance Matters More Than You Think

Traveling to Europe can be a dream come true — but it can quickly turn into a nightmare without proper insurance coverage. When applying for a Schengen visa, one of the strictest yet most overlooked requirements is securing Schengen Travel Insurance. Without it, your visa application will be rejected, and your travel plans put on hold.

From unexpected medical emergencies to trip cancellations, travel insurance isn’t just a bureaucratic requirement — it’s a lifeline for international travelers. The problem many travelers face is finding Schengen Visa Insurance that’s affordable, reliable, and meets all the legal Schengen Travel Insurance requirements.

In this guide, we’ll break down what you need to know to make an informed decision and travel with peace of mind. For more insights, check out TripInsurance.pk — a helpful resource for comparing plans and understanding your options.

Understanding Schengen Travel Insurance Requirements

Schengen Travel Insurance is compulsory for travelers visiting any Schengen country. It ensures financial security in case of medical emergencies, accidents, hospitalization, repatriation, and unforeseen incidents. The policy must meet strict embassy requirements, making Schengen Medical Insurance a fundamental part of the visa application.

Travelers often underestimate healthcare costs in Europe. A simple medical treatment can be extremely expensive, and hospitalization costs can escalate quickly. With Schengen Visa Health Insurance, travelers are safeguarded against sudden expenses, ensuring complete peace of mind and compliance with visa rules. It also protects travelers from disruptions such as trip cancellations or unexpected situations.

To visit any of the 27 Schengen countries, your insurance policy must comply with the specific guidelines set by Schengen member states.

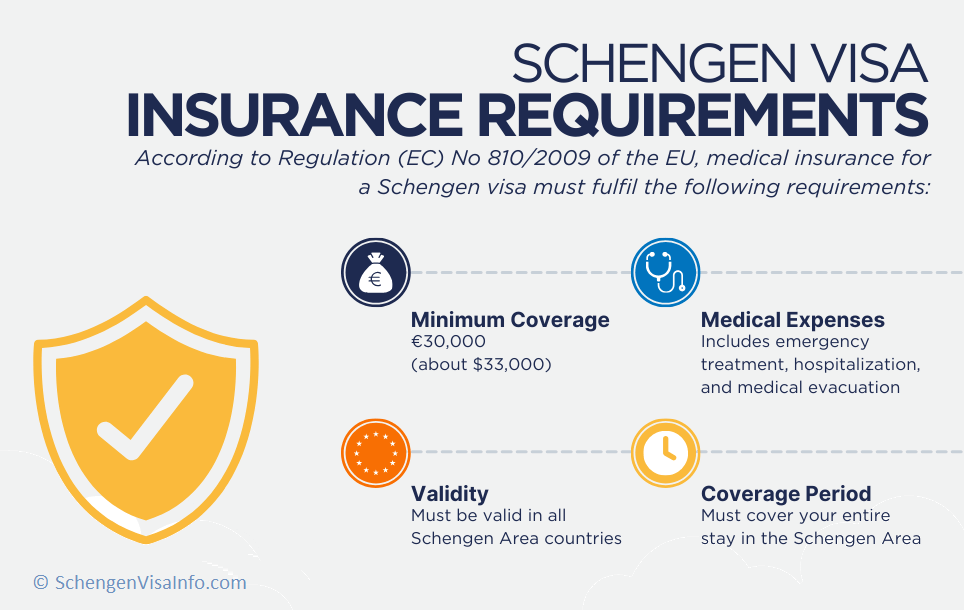

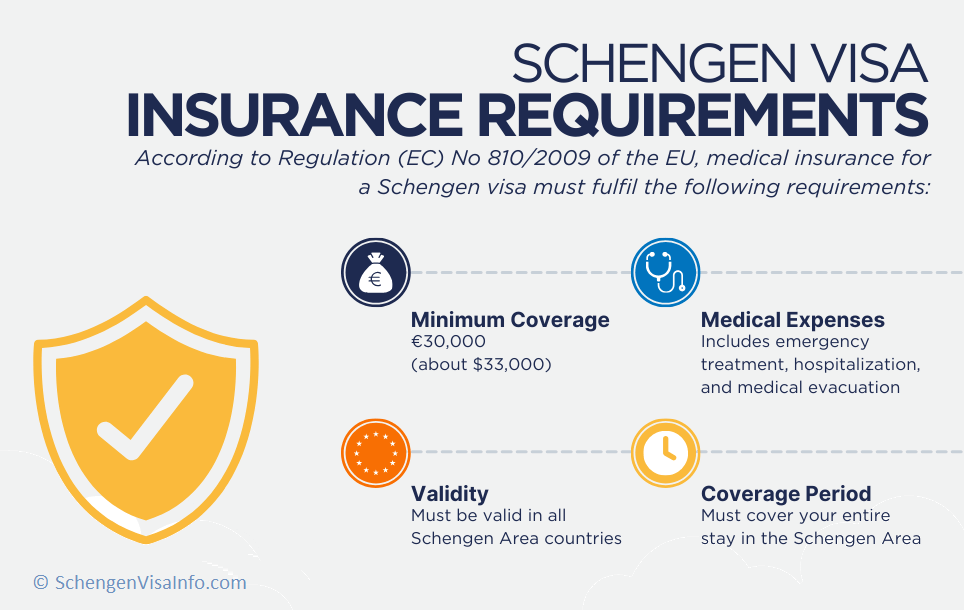

Minimum Requirements for Schengen Visa Insurance

To ensure your insurance is accepted by embassies, the policy must follow specific Schengen Travel Insurance Requirements:

-

Cover at least €30,000 (approx. $33,000 USD) in medical expenses.

-

Be valid for all Schengen countries during your entire stay.

-

Cover emergency medical treatment, hospitalization, and repatriation.

-

Be provided by an insurance company approved in the Schengen area.

These criteria are non-negotiable. Even if you have domestic insurance, it likely won’t cover your European trip unless specifically stated.

What Does Schengen Medical Insurance Typically Include?

When choosing the Best Schengen Travel Insurance, travelers should prioritize value, coverage strength, embassy acceptance, and service quality. A suitable policy should deliver:

Without this coverage, travelers risk not only financial burdens but also visa rejection. That's why Schengen Visa Health Insurance is one of the most crucial aspects of planning a Europe trip.

How to Choose the Best Schengen Travel Insurance

Not all policies are created equal. Here's how to select the most appropriate Europe Travel Insurance for your needs.

Factors to Consider

-

Coverage Amount: Ensure it meets the €30,000 minimum and ideally exceeds it.

-

Network of Hospitals: Look for insurers with global or Europe-wide hospital partnerships.

-

Claim Process: Choose providers with easy, online claim processes.

-

Cost vs Coverage: Don’t just chase the cheapest option; check what’s actually covered.

Recommended Coverage Inclusions

-

Medical treatment coverage

-

Loss of passport or luggage

-

Personal liability insurance

-

Trip cancellation or delay

-

Accidental death or disability

You can compare policies and find suitable options at TripInsurance.pk — a great platform for evaluating Schengen Travel Insurance providers without overwhelming sales pressure.

Comparing Cheap Schengen Travel Insurance Options

Saving money is always a goal, but cutting corners on insurance isn’t wise. Here’s how you can find Cheap Schengen Travel Insurance that still offers great value.

Tips to Lower Insurance Costs

-

Buy early: Last-minute policies often come with higher premiums.

-

Choose only necessary add-ons: Skip unnecessary extras like adventure sports if you won't be participating.

-

Compare plans: Use platforms like TripInsurance.pk to weigh cost vs. benefit.

Affordable Yet Reliable Providers

-

AXA Assistance

-

Europ Assistance

-

Allianz Travel

-

HanseMerkur

These providers consistently offer affordable plans that comply with Schengen visa insurance coverage requirements.

Common Mistakes to Avoid When Buying Travel Insurance for Europe

Even seasoned travelers sometimes make insurance blunders. Here’s what to watch out for:

-

Buying non-Schengen-compliant policies: Just any international insurance won’t do — check Schengen-specific compliance.

-

Underestimating trip duration: Ensure your policy covers every single day, including arrival and departure.

-

Ignoring pre-existing condition exclusions: Disclose all relevant medical history to avoid denied claims.

-

Forgetting to check coverage regions: Make sure all countries on your itinerary are listed.

Avoiding these pitfalls ensures your Travel Insurance for Europe Trip works for you when it matters most.

FAQs: Everything You Need to Know About Schengen Travel Insurance

What is Schengen Travel Insurance and why do I need it?

It’s a type of travel insurance required to enter Schengen countries, covering medical emergencies, repatriation, and more. It’s mandatory for visa applicants.

Can I use my regular health insurance for a Schengen Visa?

In most cases, no. Your regular health insurance likely doesn't meet the €30,000 minimum or cover European hospitals and repatriation.

How much does Schengen Visa Insurance cost?

Prices vary based on age, length of stay, and coverage, but plans generally start around $30–$60 for short stays.

What happens if I don’t have valid insurance when applying for a Schengen Visa?

Your visa application will be rejected. Proof of insurance is a strict requirement for all Schengen visa categories.

Is COVID-19 coverage required?

While not mandatory, it’s strongly recommended as many European hospitals may not treat non-residents without adequate coverage.

Can I extend my Schengen Travel Insurance if my trip gets longer?

Yes, but you must do it before the current policy expires and ensure the extension meets all visa insurance requirements.

Conclusion: Travel Smart, Travel Protected

Securing Schengen Travel Insurance is not just a visa formality — it’s a critical safeguard that ensures your health, finances, and travel plans are protected. Whether you’re traveling for leisure, work, or study, understanding Schengen Travel Insurance requirements and choosing the right policy gives you confidence and security throughout your journey.

For those seeking tailored guidance, tools to compare providers, and affordable options, TripInsurance.pk offers a trusted resource for every step of your planning process. Don’t wait until the last minute — make Schengen Visa Insurance a top priority on your pre-travel checklist.

Ready to explore Europe with peace of mind? Dive deeper into your insurance options at TripInsurance.pk and get the protection you need for a worry-free adventure.