Affordable Travel Insurance 2026: Best & Low Cost Plans for Travellers

Cheap Travel

Travel Insurance

Pakistan Travelers

Student Insurance

International Travel

Budget Insurance

Cheap insurance

Affordable Insurance

Insurance

Last updated on 15 Jan, 2026

Traveling abroad is exciting—but for many Pakistani travelers, finding cheap travel insurance that is both reliable and comprehensive feels overwhelming. Rising airfare, visa fees, accommodation costs, and currency fluctuations already stretch travel budgets. Adding insurance on top often feels like an unnecessary expense—until something goes wrong.

In 2026, travel uncertainties have increased. Medical emergencies, trip delays, lost baggage, and visa refusals are real risks. The good news? Affordable and dependable coverage does exist. This guide explains how Pakistani travelers can secure budget travel insurance without sacrificing essential protection—whether traveling for tourism, studies, or business.

Explore flexible plans directly through our official platform at https://tripinsurance.pk/.

Why Travel Insurance Is No Longer Optional in 2026

Travel insurance is not just a formality—it is a financial safety net. Many countries now require proof of international travel insurance as part of the visa process, while others strongly recommend it due to high healthcare costs.

Travel insurance protects you against:

-

Unexpected medical expenses abroad

-

Trip cancellation or interruption

-

Lost baggage insurance claims

-

Emergency evacuations

-

Visa-related compliance issues

Choosing the cheapest travel insurance without understanding coverage limits can backfire. Smart travelers focus on value—not just price.

Understanding Affordable Travel Insurance for Pakistan Travelers

A common misconception is that the cheapest travel insurance automatically means poor protection. In reality, affordability depends on choosing the right plan for your travel needs—not overpaying for unnecessary benefits.

Affordable plans typically include:

-

Travel medical insurance for emergencies

-

Overseas health cover at partner hospitals

-

Trip cancellation cover for unforeseen events

-

Limited but sufficient baggage protection

By avoiding luxury add-ons and selecting destination-specific plans, Pakistani travelers can secure budget travel insurance that meets visa requirements and personal safety needs without inflated costs.

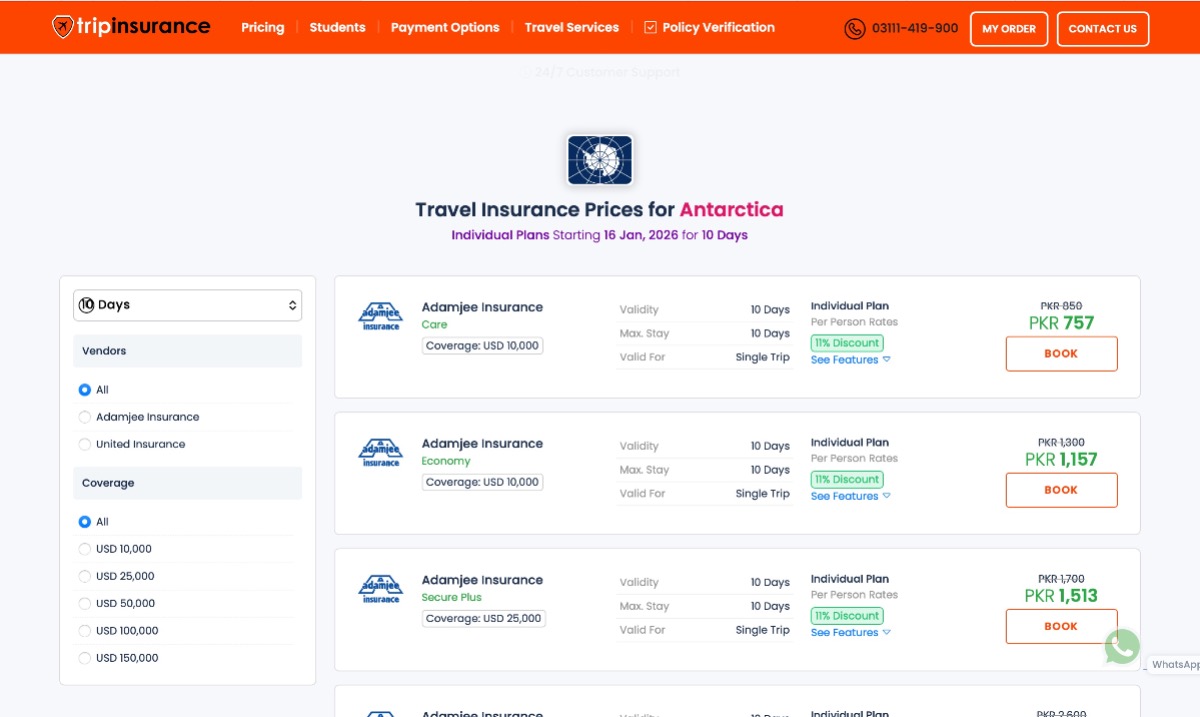

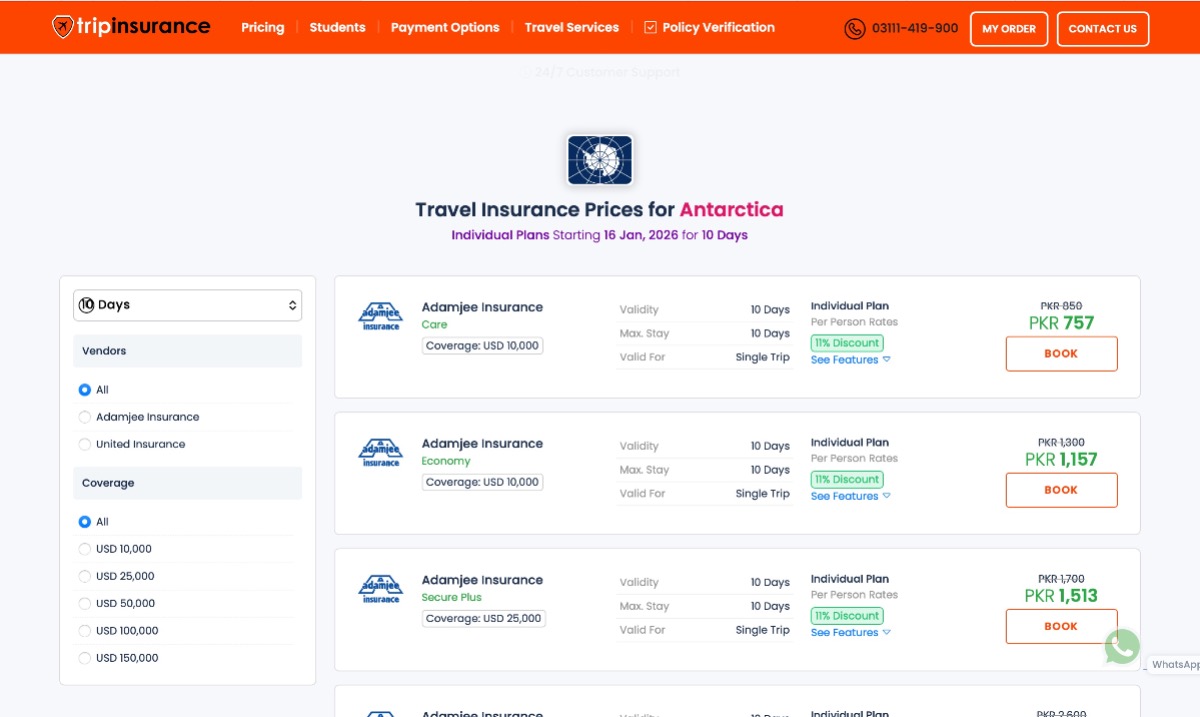

International Travel Insurance by Destination

Different destinations require different coverage levels. Understanding this helps you avoid overpaying.

Travel Insurance Schengen

Schengen countries require:

Affordable Schengen plans are widely available and visa-approved.

Travel Insurance for USA / Canada / UK

Healthcare costs in these regions are high. A basic emergency visit can cost thousands of dollars. Budget-friendly plans still offer:

Spending slightly more here prevents massive out-of-pocket expenses later.

Student Travel Insurance: Affordable Protection for Study Abroad

Students traveling overseas often need specialized coverage. Student travel insurance is designed for longer stays and academic requirements.

Typical benefits include:

-

Extended overseas health cover

-

Mental health and emergency care

-

Study interruption protection

-

Affordable annual multi-trip insurance options

You can explore competitive student plans and pricing here:

👉 https://tripinsurance.pk/pricing/student

What Makes a Policy Truly Budget-Friendly?

The cheapest option isn’t always the best. Smart travelers look for balance.

Key Features to Check

-

Adequate travel medical insurance limits

-

Transparent exclusions

-

Easy claims process

-

Coverage for trip cancellation cover

-

Emergency support availability

A slightly higher premium with broader coverage often saves money in the long run.

How to Buy Travel Insurance Online in Pakistan

Today, purchasing travel insurance online Pakistan is fast and hassle-free. Instead of visiting agents or embassies, travelers can compare policies digitally and receive instant documentation.

Steps to Get Started

-

Select your destination and travel dates

-

Compare travel insurance quotes

-

Choose coverage based on visa and health needs

-

Purchase and download your policy instantly

Online platforms make travel insurance comparison transparent and cost-effective.

Single-Trip vs Annual Multi-Trip Insurance

For travelers, choosing the right type of travel insurance is crucial, especially if you travel often or have expensive trips planned. Understanding the difference between single-trip and annual multi-trip insurance can help you save money while ensuring adequate protection.

-

Single-Trip Insurance: This type of insurance covers one specific journey. It’s ideal for occasional travelers, such as a vacation, a study trip, or a family visit abroad. You pay for coverage only for the duration of that particular trip, which makes it simple and cost-effective for short-term travel. Policies usually include essential coverage like medical emergencies, trip cancellation, and lost baggage, giving you peace of mind for that single journey.

-

Annual Multi-Trip Insurance: Designed for frequent travelers, business professionals, or anyone taking multiple trips in a year, this plan provides continuous coverage for all trips within a 12-month period. While the initial cost is higher than a single-trip policy, the per-trip cost is often much lower, making it more economical for regular travelers. These plans typically offer flexible coverage for different destinations, emergency medical support, trip interruption, and baggage protection. Additionally, you don’t have to purchase insurance before every trip, saving both time and hassle.

Choosing between single-trip and annual multi-trip insurance depends on your travel frequency, destinations, and budget. For travelers planning multiple journeys in 2026, an annual multi-trip plan is usually the smarter investment, offering convenience and continuous protection without breaking the bank.

Common Mistakes When Buying Cheap Travel Insurance

Avoid these pitfalls:

-

Choosing the lowest price without checking coverage

-

Ignoring destination-specific requirements

-

Skipping medical coverage limits

-

Not comparing travel insurance quotes

Informed decisions lead to safer, stress-free journeys.

FAQs About Cheap Travel Insurance

1. Is cheap travel insurance reliable for international trips?

Yes, as long as it includes essential coverage like travel medical insurance and emergency care.

2. Can I buy travel insurance online in Pakistan instantly?

Absolutely. Many platforms offer instant purchase and digital policy delivery.

3. Do students need special travel insurance?

Yes. Student travel insurance offers extended coverage suitable for long-term stays abroad.

4. Is travel insurance mandatory for Schengen visas?

Yes. Travel insurance Schengen coverage is a visa requirement.

5. How can I find the cheapest travel insurance?

Compare travel insurance quotes online and choose coverage based on your needs—not just price.

Final Thoughts: Smart Protection Without Overspending

Securing cheap travel insurance in 2026 is not about cutting corners—it’s about making informed choices. Pakistani travelers now have access to transparent, affordable, and visa-compliant options that protect against medical emergencies, trip disruptions, and unexpected losses.

Before your next journey:

For trusted solutions and updated plans, visit:

🌍 https://tripinsurance.pk/

Travel smart. Travel protected. ✈️